The CEO's Guide to Effective Compliance

- Raimund Laqua

- Aug 19

- 7 min read

Updated: Aug 21

Every compliance decision your organization makes is either systematically building competitive advantage or destroying value. There is no middle ground, and the stakes are higher than most executives realize.

The visible compliance costs—$10,000+ per employee annually for training, audits, and regulatory activities—represent only the surface of your true investment. The hidden multiplier lies in operational design choices that either create integrative business capabilities or construct expensive bureaucratic overhead that constrains growth while failing to manage risk effectively.

The data is clear: Organizations with strategic compliance-design, outperform market indices by 7.8-13.6% through three proven mechanisms: increased operational margins that absorb unavoidable risks, systematic elimination of costly waste from preventable failures and misalignment, and enhanced stakeholder trust that commands premium market valuations.

The opportunity is now: Companies making this transformation early will establish sustainable market leadership, while those that delay will find themselves competing against superior operational capabilities built by more strategic competitors.

This guide provides the business case, methodology, and action plan for transforming compliance from oversight burden to operational capability aligned with organizational success.

The Strategic Reality Every C-Suite Faces

You already know compliance consumes significant resources. What you may not realize is that the visible costs—UConn research documents $10,000+ per employee annually in healthcare, financial services, and manufacturing for training, audits, and regulatory activities—represent only the surface of your true investment.

The hidden multiplier lies in operational design. Every compliance decision you make either builds integrative business capability or constructs expensive bureaucratic overhead. The difference determines whether your organization joins the proactive out-performers or remains trapped in reactive cost multiplication.

The data is clear: Ethisphere's World's Most Ethical Companies consistently outperform market indices by 7.8% to 13.6% over five-year periods. McKinsey research shows organizations with strategic compliance approaches achieve 10-30% improvements in customer satisfaction while reducing administrative overhead by 20%.

This isn't correlation—it's causation through operational design.

The Hidden Cost Multiplier Most Executives Never Calculate

Traditional compliance approaches don't just consume the visible $10,000 per employee. They systematically multiply your true investment through:

Operational Fragmentation: Separate systems requiring dedicated staff, manual reconciliation, and constant coordination across departments. Each silo demands its own technology stack, reporting processes, and management attention.

Process Inefficiency: Extended cycle times for business decisions waiting for compliance approvals. Multiple hand-offs creating delay and error opportunities. Duplicated assessments across functions that should be integrated.

Executive Attention Waste: C-suite time diverted from strategic growth to crisis management. Board meetings dominated by compliance issues rather than market opportunities. Management bandwidth consumed by problems that integrated design prevents.

Opportunity Cost: Resources locked in defensive postures rather than competitive advantage creation. Innovation constrained by processes designed around limitation rather than enablement.

The strategic question isn't how much you're spending on compliance—it's whether your current approach is building operational capabilities that contribute to business performance or constructing barriers that constrain growth while failing to effectively manage risk.

Why Traditional Approaches Guarantee Poor Performance

Most compliance programs operate on what Lean Compliance founder Raimund Laqua identifies as "The Reactive Uncertainty Trap"—waiting for audits, incidents, or regulatory action before improving posture. This creates a vicious cycle where organizations work frantically while remaining "one mishap, one violation, or one incident away from mission failure."

The fundamental design flaw is that traditional approaches treat compliance as an oversight function rather than operational capability. This creates artificial separation between risk management and value creation, forcing choose-or-lose decisions where alignment would optimize both by improving the probability of intended outcomes and reducing the probability of unintended consequences.

Academic research from Harvard Business School and University of Pennsylvania demonstrates that this separation creates measurable business disadvantages:

Reduced operational efficiency through duplicated processes

Increased decision latency through fragmented approval chains

Diminished stakeholder trust through reactive rather than proactive positioning

Constrained innovation through defensive rather than enabling frameworks

The competitive impact created by organizations maintaining traditional approaches is that they systematically under-perform across customer satisfaction, employee engagement, operational efficiency, and financial returns—not because they lack resources, but because:

their compliance design multiplies costs while constraining performance.

How Leaders Transform Capability into Value

Organizations achieving competitive advantage don't spend more on compliance—they design it differently.

The breakthrough methodology centres on operational alignment: embedding compliance capabilities directly into business processes rather than maintaining them as separate oversight functions.

Effective compliance programs create total value advantage through three strategic capabilities:

Increase Margin to Absorb Irreducible Risk: Compliance excellence boosts operational productivity, creating financial and non-financial cushions against unavoidable risks—the chance events and natural variability you cannot eliminate but must prepare for. Organizations with superior compliance capabilities maintain higher margins that enable strategic flexibility during market disruptions, regulatory changes, or operational challenges.

Buy Down Reducible Risk by Reducing Waste and Non-Value Activities: Strategic compliance drives down reducible risk that generates costly waste: defects, non-conformance, violations, incidents, injuries, fines, penalties, and other preventable consequences caused by epistemic uncertainty (lack of knowledge) or operational negligence. This isn't just cost avoidance—it's systematic elimination of value-destroying activities that constrain growth and profitability.

Add Value in Stakeholder Perception and Market Positioning: Organizations that pursue operational excellence—operating safely, securely, with integrity, and delivering consistent quality—earn greater trust from customers, investors, regulators, and communities while commanding higher market valuations. This stakeholder confidence translates directly into competitive advantages: preferred customer relationships, lower cost of capital, regulatory cooperation, and community support for expansion initiatives.

These capabilities are strengthened by operational compliance design principles:

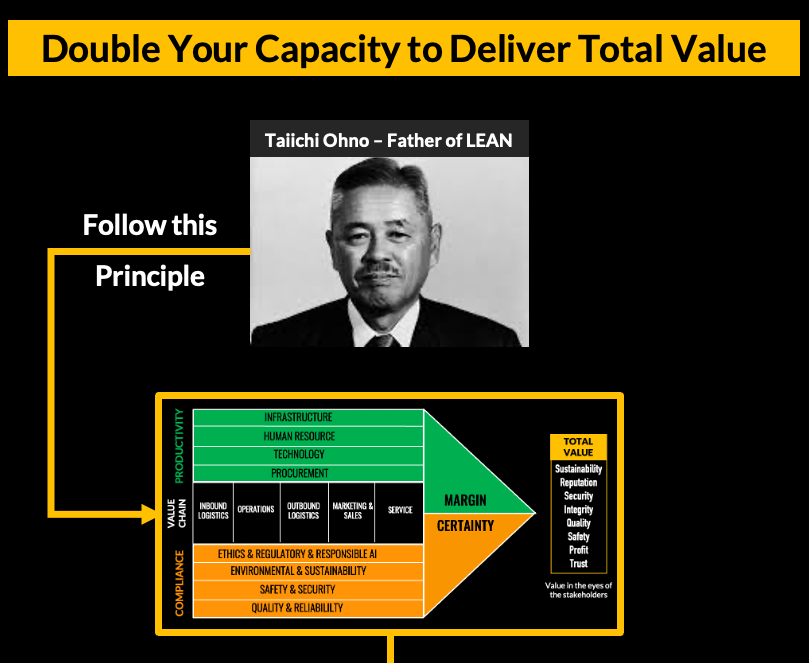

Value Chain Alignment: Using Lean Compliance's Total Value Chain Analysis (their adaptation of Michael Porter's framework for risk and compliance), leading organizations map compliance activities across primary business processes—inbound logistics, operations, outbound logistics, marketing/sales, and service—creating horizontal capability rather than vertical bureaucracy.

Technology Enablement: Modern compliance platforms provide real-time monitoring, predictive analytics, and automated workflows that eliminate manual processes while improving accuracy and responsiveness. This creates what systems theorists call "emergent properties"—capabilities that arise from system interactions rather than individual components.

Proactive Certainty: Rather than reactive problem-solving, proactive approaches enable "staying between the lines and ahead of risk" through continuous monitoring and predictive intervention.

The operational result is that compliance becomes a business enabler and stabilizer rather than business constraint, reducing total cost of ownership while simultaneously increasing margin resilience, operational efficiency, and stakeholder value creation.

The Board-Level Business Case

The compounding benefits from this approach include:

Financial Performance: Academic research consistently demonstrates that organizations with integrative compliance programs outperform peers across revenue growth, cost efficiency, and shareholder returns. The "Ethics Premium" tracked by Ethisphere shows sustained out-performance over multiple economic cycles.

Risk Mitigation: Proactive compliance reduces both regulatory risk and operational risk while building stakeholder trust that creates market advantages during periods of uncertainty or crisis.

Market Positioning: In an environment where 80% of company value derives from intangible assets—brand reputation, stakeholder trust, operational excellence—compliance capabilities directly impact market valuation and competitive sustainability.

Talent Advantage: Organizations known for operational excellence and ethical leadership consistently attract and retain superior talent while reducing the costs and risks associated with cultural misalignment.

The Strategic Opportunity

The choice facing every C-suite is clear continue viewing compliance as necessary burden while competitors systematically build operational advantages, or recognize compliance transformation as one of the most significant opportunities for business excellence and market differentiation available in today's competitive environment.

The window for competitive advantage through compliance excellence is narrowing. Organizations that successfully make this transformation early will establish sustainable market positioning. Those that delay will find themselves competing against superior operational capabilities built by their more strategic competitors.

The question isn't whether compliance can drive business value—the research proves it can and does. The question is whether your organization will capture that value through strategic transformation or continue multiplying hidden costs through operational fragmentation.

The companies that recognize and act on compliance as competitive advantage will define the next generation of market leadership. The companies that don't will find themselves systematically disadvantaged across every metric that matters to long-term success.

Your Strategic Plan for Compliance Value

Assess Your True Investment and Value Creation - Identify compliance costs beyond visible budget items: dedicated FTE costs across departments, technology investments, process inefficiency costs due to uncertainty, and opportunity costs from constrained innovation. Simultaneously conduct Total Value Chain Analysis using Lean Compliance's methodology to evaluate how compliance activities affect every primary business process and identify alignment opportunities for compliance capabilities to enhance rather than constrain operational and organizational performance.

Design for Total Value Advantage - Establish the three strategic capabilities of effective compliance: increase operational margins through productivity improvements that create financial cushions, systematically eliminate reducible risks that generate costly waste (defects, violations, incidents, penalties), and build stakeholder value through operational excellence that earns trust and commands higher market valuations. Transform compliance from external oversight to embedded operational capability aligned with business decision-making and value creation.

Implement Integrative Technology and Governance - Deploy predictive technology platforms enabling real-time monitoring that support organizational and operational alignment. Establish cross-functional teams with compliance expertise embedded in operational decisions while ensuring proactive obligation and risk management. Focus on systems that provide business intelligence for strategic decision-making while achieving regulatory requirements as a natural outcome of operational excellence.

It’s time to prioritize compliance as a competitive advantage over operational overhead. This demands CEO-level strategic vision and organizational commitment to integrative design, not partial optimizations across silos adjacent but not aligned to the value chain.

Lean Compliance's The Total Value Advantage Program™ represents an integrative approach that combines LEAN methodology with proactive compliance strategies to transform how organizations meet all their obligations, including regulatory requirements, voluntary commitments, and production obligations.

Organizations implementing this program experience measurable improvements across multiple critical areas including enhanced safety protocols, strengthened security measures, improved sustainability practices, elevated quality standards, robust legal adherence, and reinforced ethical conduct.

These outcomes extend beyond traditional compliance metrics to encompass the full spectrum of organizational outcomes, delivering improvements in compliance efficiency, reduced operational waste, and enhanced operational confidence.

This program is designed for organizations seeking to transform their compliance function from a necessary burden into a competitive advantage that supports broader business objectives, organizational mission, and the complete range of regulatory and voluntary commitments.