Understanding Operational Compliance: Key Questions Answered

- Raimund Laqua

- Jun 15, 2025

- 3 min read

Updated: Jun 26, 2025

Organizations investing in compliance often have legitimate questions about how the Operational Compliance Model relates to their existing frameworks, tools, and investments.

These questions reflect the reality that most organizations have already implemented various compliance approaches—ISO management standards, GRC platforms, COSO frameworks, Three Lines of Defence models, and others.

Rather than viewing these as competing approaches, the Operational Compliance Model serves as an integrative architecture that amplifies the value of existing investments while addressing fundamental gaps that prevent compliance from achieving its intended outcomes.

The following responses explore how Operational Compliance works with, enhances, and elevates traditional approaches to create the socio-technical systems necessary for sustainable mission and compliance success.

Responses to Questions

"Why can I not use an ISO management systems standard?"

ISO management standards are excellent for procedural compliance but fall short of achieving operational compliance. Operational Compliance defines a state of operability when all essential compliance functions, behaviours, and interactions exist and perform at levels necessary to create the outcomes of compliance.

The fundamental limitation is that ISO standards focus on building parts of a system (processes, procedures, documentation) rather than the interactions between parts that create actual outcomes. Companies usually run out of time, money, and motivation to move beyond implementing the parts of a system to implementing the interactions which is essential for a system to be considered operational.

ISO standards help you pass audits, but the Operational Compliance Model helps you achieve the outcomes those audits are supposed to ensure—better safety, security, sustainability, quality, and stakeholder trust.

"Doesn't GRC cover this, at least for IT obligations?"

GRC (Governance, Risk, and Compliance) platforms are tools, not operational models. Traditional "Procedural Compliance" is based on a reactive model for compliance that sits apart and is not embedded within the business. Most GRC implementations create sophisticated reporting systems but don't address the fundamental challenge: how to make compliance integral to value creation.

The Operational Compliance Model recognizes that obligations arise from four types of regulatory design (micro-means, micro-ends, macro-means, macro-ends) that each require different approaches. GRC tools can support this model, but they can't create the socio-technical processes that actually regulate organizational effort toward desired outcomes.

"I already have dozens of frameworks"

This objection actually proves the need for the Operational Compliance Model. Having dozens of frameworks is precisely the problem—it creates framework proliferation without operational integration. Lean TCM incorporates an Operational Compliance Model that supports all obligation types and commitments using design principles derived from systems theory and modern regulatory designs.

The Operational Compliance Model doesn't replace your frameworks; it provides the integrative architecture to make them work together as a system rather than competing silos. It's the difference between having a collection of car parts versus having a functioning vehicle.

"What about COSO? This already provides an overarching framework?"

COSO is excellent for internal control over financial reporting but was designed primarily for audit and governance purposes. The Operational Compliance Model addresses several limitations of COSO:

Scope: COSO focuses on control activities; Operational Compliance focuses on outcome creation

Integration: COSO's five components work within compliance functions; Operational Compliance embeds compliance into operations

Regulatory Design: COSO assumes one type of obligation; Operational Compliance handles four distinct types that require different approaches

Uncertainty: COSO manages risk; Operational Compliance improves probability of success in uncertain environments

COSO can be a component within the Operational Compliance Model, but it's insufficient by itself to achieve operational compliance.

"What about Audit 3 Lines of Defence?"

The Three Lines of Defence model is fundamentally reactive—it's designed to catch problems after they occur. Operational Compliance is based on a holistic and proactive model that defines compliance as integral to the value chain.

The limitations of Three Lines of Defence:

Line 1 (operations) sees compliance as separate from their real work

Line 2 (risk/compliance) monitors rather than enables performance

Line 3 (audit) confirms what went wrong after the fact

The Operational Compliance Model collapses these artificial lines by making compliance inherent to operational processes. Instead of three defensive lines, you get one integrated system where compliance enables rather than constrains performance.

The Essential Difference

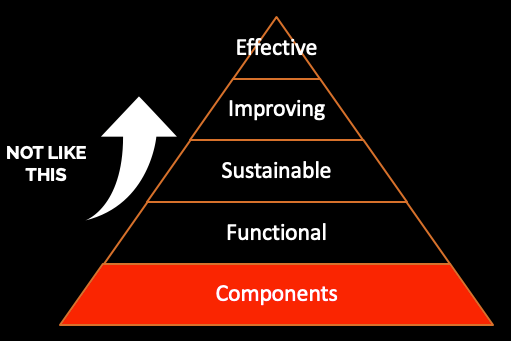

For compliance to be effective, it must first be operational—achieved when all essential compliance functions, behaviours, and interactions exist and perform at levels necessary to create the outcomes of compliance.

The majority of existing frameworks and models serve important functions, but they operate within the procedural compliance paradigm.

The Operational Compliance Model represents a paradigm shift from compliance as overhead to compliance as value creation—from meeting obligations to achieving outcomes.